A fresh, new process for SBA lending. ForeverTrackTM adds significant income to the bottom line for business intermediaries, commercial real estate brokers, bankers and small business advisors who work with prospective SBA borrowers of loans over $350,000.

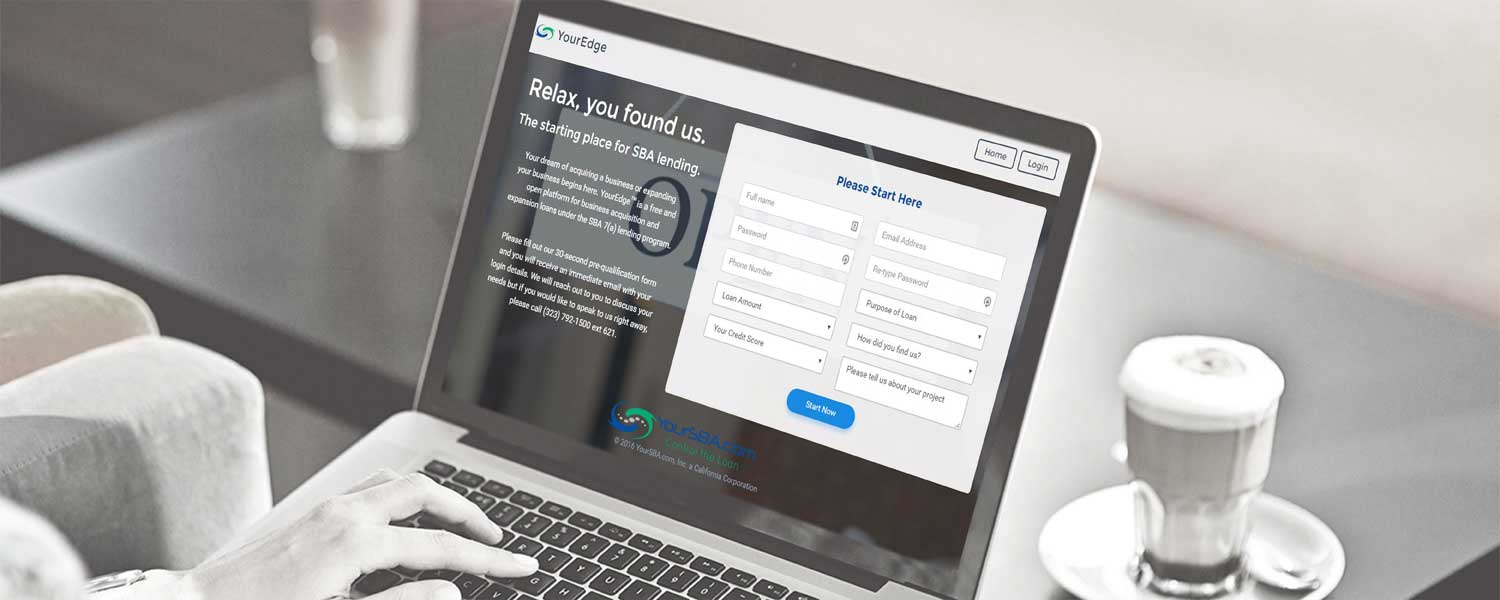

Edge is a free and easy to use starting place for business owners and borrowers. We've worked for over 2 years to create, from the ground up, the first SBA lending platform to tackle the biggest problems borrowers face when working directly with a lender or trying to use a loan broker. YourSBA.com's Edge platform offers the fastest, most efficient path to an SBA loan. It's also free and has the highest success rate in the industry with a success rate from 2013 of 95%.

Pre-qualify within 24 hours or less.

We are the national experts for SBA 7(a) loans for the purpose of buying or expanding your business from $350,000 to over $5 million. Edge should be the borrower's only stop when applying for an SBA loan.

Our SaaS platforms offer a streamlined and simplified loan application process for borrowers. In addition, our secure platforms push status updates to all parties involved in the transaction. Again, an industry-first.

Track your leads and earn generous referral fees on any lead you submit, regardless of when they buy and who they buy from.

Because we work directly with the CEOs and Managing Directors of our bank partners, you are closer to the credit decision makers than if you’re standing in the lobby of your own bank. Each bank has its own favorite lending “zones” and biases — we know what banks like.

Register here: Start Now

Submit your leads: Login

The lead will be assigned to you and will remain assigned to you.

The lead can be at any stage of the buying process: Starting their search for a business or property, submitted an LOI, turned down by your bank or walking away from the negotiating table.

Our team will follow up with each lead until they make a purchase or opt out.

If the lead ends up working with us to obtain an SBA loan, we will send you a check. Make sure you get signed up with us soon - we are currently matching referral fees paid by banks and brokers.

Want an added bonus? Ask us to provide references from business brokers and CRE brokers we have sent buyers to. Because we a national firm, we are able to send our business partners buyers and prospects from our national advertising campaigns and our referral network. Stay tuned for some videos from our founder on this topic.

We are a technology company. Our SaaS platforms were created to make the SBA lending experience as smooth as possible for borrowers and business owners. We find the decades old process of going from bank to bank to bank to be outdated. Even worse, it creates a massive security risk for borrowers. Edge is the starting place for SBA lending.

In addition, we find the process of borrowers having to search for and hire loan brokers to find the right lender to be outdated and unnecessarily expensive. Why hasn’t the lending industry caught up with the rest of business world? It finally has with Edge.

As an added benefit to your company, let us work with you to create a secure and effective website, with the proper security in place, so borrowers can get prequalified and started with the SBA lending process right from your website. ForeverTrackTM is much more than a name, it is the beginning of something new. Don’t miss out on the opportunity of partnering with us. Once you’ve experienced the SBA lending process with our system and our team, you will want to work with us for all future transactions. This has become such an important part of our business that we have created an additional avenue for you to make money by partnering with us — ask us about our new brand ambassador program.

Faq

The Small Business Administration (SBA) is a federal agency dedicated to strengthening America's small businesses through initiatives such as the SBA 7(a) loan program. Because the US Government guarantees a large percentage of the loan, the risk to the bank is decreased, thus encouraging them to offer more favorable terms to you, the borrower, such as:

Do not worry. Many of our past clients had been declined by a bank before working with us to successfully secure their loans. Every bank is different. It is our job to know which bank wants your business.

This is a common misconception. As a general rule, the same amount of paperwork is required regardless of the size of the loan. Of course, a lender may look at a larger loan with more scrutiny than a smaller loan. We are the experts for SBA 7(a) loans larger than $350,000 for the purpose of purchasing a business or expanding your successful company.

Often referred to as the “Swiss Army Knife” of the SBA loan programs, the 7(a) loan program is the most versatile. Some of the uses are:

You are in the right place. We will help you to secure the loan to purchase the business. Please start here for a same-day pre-approval. Start Here

Feel free to estimate the SBA lending scenario with our popular SBA loan calculator. Loan Calc

A business plan is a great tool for building a lender's confidence in you as a borrower. Our team has expertise across all industries and will assist you in completing your business plan.